MiWay Case Study

Increasing GWP through broad match keywords & VBB

The Challenge

MiWay Insurance, a leading provider of short-term insurance, embarked on a strategic campaign in May 2023 to boost their online-to-offline (O2O) policies, grow their gross written premiums (GWP), and achieve outstanding performance.

MiWay Insurance faced the challenge of maximizing their reach and attracting potential customers in the competitive car insurance market. They recognized the need to optimize their search campaigns to drive quality traffic, increase policy sales, and ultimately improve their bottom line.

The AWO Strategy

Absa Short-Term Insurance (STI) executed a comprehensive strategy leveraging a full-funnel approach to navigate the dynamic two-speed consumer journey. By balancing brand-building and performance-focused messaging across stages of awareness, interest, desire, and action, STI maximized campaign efficacy and achieved significant success in the competitive insurance sector.

The Strategy

Keyword Strategy:

MiWay Insurance conducted extensive keyword research and expanded their keyword portfolio to include broad match keywords. This approach allowed them to capture a wider range of search queries related to car insurance, driving increased visibility and potential customer engagement.

ROAS Bid Strategy

To optimize their return on investment, MiWay Insurance implemented a ROAS bid strategy. This approach allowed them to set bids based on the desired return on ad spend, enabling them to allocate their budget effectively and prioritize higher-converting keywords.

Ad Copy Optimization:

MiWay Insurance crafted compelling ad copies that highlighted the unique selling points of their car insurance offerings. They emphasized factors such as affordable premiums, comprehensive coverage, and excellent customer service to resonate with their target audience and drive engagement.

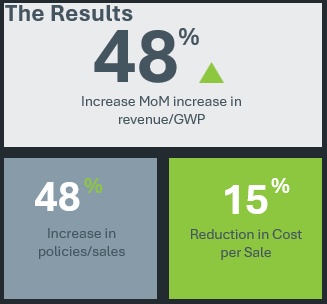

MiWay Insurance’s implementation of a comprehensive strategy combining broad match keywords, a ROAS bid strategy, and persuasive ad copy proved highly successful in May 2023. This approach allowed them to reach a broader audience, drive quality traffic, increase gross written premiums and policy sales, and improve their overall campaign performance to exceed May targets.